Digital Transformation Guide for Mortgage Lenders in the US

The mortgage industry in the USA is now at a junction where lenders want to take the road to digital transformation or stick to the conventional process of LOS/LMS. Mortgage rates in the US have dropped to below 3% for the first time ever in July 2020, which means that many people would apply for residential loans.

When this happens most of the lenders would be overwhelmed with the amount of work they have as this many applications would choke the pipeline, to review and approve these loans in time and at speed without errors would be a humanly impossible task unless they use technology that not only augments current workload but also shows promises to a sustainable future.

Key considerations for transformation

In order to achieve a smooth and rapid transformation, a lender must consider the following:

- What are your digital transformation goals and objectives?

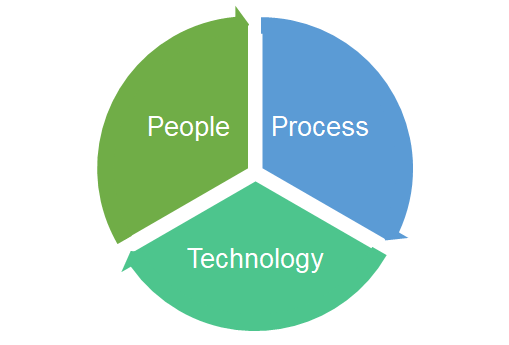

- What role do people, processes, and technology play in your strategy?

- How does your organizational culture manage change?

- What is the organizational commitment to training?

- Is there a formal process of governance?

- Are the business and technology strategies synchronized?

- How does your strategy align with your 3rd Party providers?

Answers to the above questions would lead to ordering things in priority and capturing the most critical business aspects on a first thing first basis.

How does it work today?

A typical Loan origination process covers the following aspects-

People – Applicant starts with 1003 data collection, uploads documents, and provides access to digital data.

Loan Processors/Underwriters:

- Updates from 1003 form, ingest and organize documents.

- Extracts document content data.

- Underwrites loan and request additional docs and info.

- Approves or denies a loan.

Funder/Closer:

- Reviews loan and UW conditions(Stare & Compare).

- Prepare a closing package.

- Coordinate closing with buyer and agent.

Post Closing – Reviews a sample of funded loans: data, documents, UW & UW conditions status(Stare & Compare) to validate quality mgmt.

What does the conventional & orthodox mortgage process result in?

- Scale up or down with people and Business process operations.

- Lost opportunities and market share.

- Reduces quality and increases errors.

- Exist in the market in response to external threats.

How digital transformation can better the end state?

It is a no-brainer that technology can act as a catalyst and help lenders accelerate the pace at which they are processing loans but that is not enough and a lender should also focus on checking the following:

- Simplify customer interaction – create a car-buying-like experience.

- Initiate and close a loan in days.

- Eliminate the originator’s risk of loan buyback – align with investor guidelines.

- Ensure proper legal position in the property – compliance with local, state, and federal requirements.

- Data is accurate – the loan will be serviceable.

- Cost containment – lowest cost per loan compared to peers.

Conclusion

In the end, it seems that adopting technology will help but the success of it highly depends on the planning and the people you are going to involve when you embark on a journey of digital transformation. Also how compliant a solution is with regulations from MISMO and how standardized the resulting solution is with Fannie Mae documents in the US.

If you like the above piece of writing I would recommend you read into our next bit in the mortgage series “How to reduce the elements of friction in Mortgage using technology”.