Effective January 5, 2023, the Corporate Sustainability Reporting Directive (CSRD) significantly expanded the scope of previous regulations. The CSRD now requires companies to disclose their environmental and societal impacts publicly and to ensure the reported data. But what does this mean in practice? Who is directly affected? What specific information needs to be reported, and when? This guide provides the essential details of the CSRD to help you navigate the legislation and understand its potential impact on your operations.

The Shift to Sustainable Finance

As sustainability transitions from an option to an imperative, the CSRD emerges as a crucial facilitator of sustainable finance. This framework is essential to the European Commission’s strategy to channel funds towards sustainable investments through transparency, offering a standardized approach to reporting Environmental, Social, and Governance (ESG) factors.

With over 50,000 companies projected to come under the CSRD’s purview, it is crucial for organizations to proactively develop their expertise, establish dedicated teams, and streamline processes to meet the reporting requirements. For large companies meeting specific criteria, initial reports are due in 2025, covering the fiscal year of 2024. Early action will ensure a smooth transition and compliance with the new regulations.

From NFRD to CSRD

The CSRD, also known as Directive (EU) 2022/2464, standardizes the disclosure of ESG matters related to companies’ activities. It strengthens and broadens the existing regulatory framework of the Non-Financial Reporting Directive (NFRD). On January 5, 2023, the CSRD replaced the NFRD, expanding its scope from around 11,700 to 50,000 companies. The CSRD aims to combat greenwashing through enhanced transparency and comparability, and it seeks to channel funds towards sustainable investments in alignment with the EU’s Green Deal and alongside the EU Taxonomy and Sustainable Finance Disclosure Regulation (SFDR) frameworks.

By July 2024, EU Member States are required to transpose the CSRD into national law. This entails aligning and enforcing processes, laws, and administrative provisions necessary for companies to comply with the CSRD at a national level without affecting the established compliance dates.

Fundamental Changes from NFRD to CSRD

The CSRD has significantly broadened the scope of its precursor, the NFRD, by expanding the range of disclosures that companies must make. Companies subject to the CSRD must now provide information about their strategy, targets, and the role of the board and management. They are also mandated to report on the Impact Risk and Opportunities (IRO) connected to the company and its value chain, intangibles, and how they have identified the information they report.

A new concept introduced in the CSRD is Double Materiality. This approach requires companies to report on how their businesses impact and are impacted by ESG matters. Additionally, the CSRD introduced rigorous sustainability reporting standards known as the European Sustainability Reporting Standards (ESRS). These standards aim to facilitate the disclosure of material topics relevant to stakeholders. Furthermore, the CSRD mandates an EU-wide requirement for limited assurance of sustainability information, moving towards reasonable assurance.

The reporting format has also undergone significant changes. Unlike the NFRD, which allowed disclosures in online or PDF format, the CSRD mandates disclosures in XHTML format, adhering to the European Single Electronic Format (ESEF) regulation. Disclosures must be seamlessly integrated into the company’s Management Report in a singular, digitally accessible format, ensuring enhanced accessibility and comparability of the disclosed information.

CSRD’s Connection to Other ESG Standards

The CSRD, EU Taxonomy, and SFDR form a pivotal triad of interconnected regulations designed to streamline and strengthen sustainable investing practices. Their collective goal is to bolster transparency regarding organizations’ sustainability, empower investors to make more informed and responsible choices and create a more transparent and accountable corporate environment.

This synergistic framework promotes sustainable finance, as the CSRD furnishes data crucial to SFDR reports. Together, the CSRD and SFDR empower investors with vital information for making informed decisions and aligning businesses with sustainable practices and financial products with ESG factors.

Furthermore, the CSRD mandates large companies to report sustainability performance aligned with the EU Taxonomy, including disclosures on Taxonomy-aligned activities. It also enforces compliance with Article 8 of the EU Taxonomy regulation. Additionally, the CSRD encompasses non-financial data points essential for financial market participants’ disclosures and crucial for completing their SFDR reports.

Who Is Subject to the CSRD, and by When?

The CSRD mandates comprehensive sustainability reporting for a wide range of entities, both inside and outside the European Union. Approximately 50,000 companies are expected to be required to report—40,000 within the EU and 10,000 outside. Recognizing the substantial undertaking that sustainability reporting represents, EU officials opted for a phased-in approach.

Companies Under The NFRD

EU companies under the NFRD, including large EU public interest firms, must report if they meet specific criteria: being listed, having over 500 employees, having a balance sheet exceeding €25 million, and a net turnover exceeding €50 million. Compliance is mandatory, with reports based on fiscal year 2024 data due in 2025.

Large Companies

Under the CSRD, large companies must meet at least two of three criteria: a balance sheet exceeding €25 million, a net turnover exceeding €50 million, or employing more than 250 individuals. Reports based on fiscal year 2025 data are required, with reporting phased in from 2025 to 2029. This staggered approach aims to ease compliance for organizations with limited resources, enhancing ESG transparency across the market.

Non-EU Companies

Non-EU companies with listed securities on EU-regulated markets, categorized as large undertakings or SMEs under EU law or with branches or subsidiaries in the EU, may also fall under the CSRD’s scope. This extension could impact over 10,000 additional companies globally, including a significant portion of US-based firms, with reporting deadlines spanning from 2025 to 2029.

Listed Small and Medium Sized Enterprises (SMEs)

Listed SMEs face slightly different reporting requirements. They are mandated to report by 2027 based on fiscal year 2026 data, meeting specific criteria regarding employees, balance sheet size, and net turnover. However, SMEs have the option to opt-out for two years, delaying compliance until 2029. Additionally, micro-enterprises listed on EU-regulated markets are exempt from CSRD requirements.

CSRD Reporting Requirements

The European Sustainability Reporting Standards (ESRS) were introduced by the European Commission as a Delegated Act under the CSRD as a set of disclosure standards to standardize ESG reporting. Officially adopted at the end of July 2023, the ESRS provides a common framework for companies to report on their sustainability performance, making it easier for investors and other stakeholders to compare and assess the sustainability of different companies.

The ESRS is divided into two primary sets of standards: the sector-agnostic or topical ESRS and the sector-specific ESRS. The sector-agnostic ESRS covers 12 ESG matters organized into four categories: Cross-cutting Standards, Environmental, Social, and Governance standards. Collectively, this amounts to approximately 1,200 data points and over 80 disclosure requirements. The sector-specific ESRS, tailored to different sectors like textiles, jewelry, food and beverages, agriculture, and energy production, will be developed by June 2026.

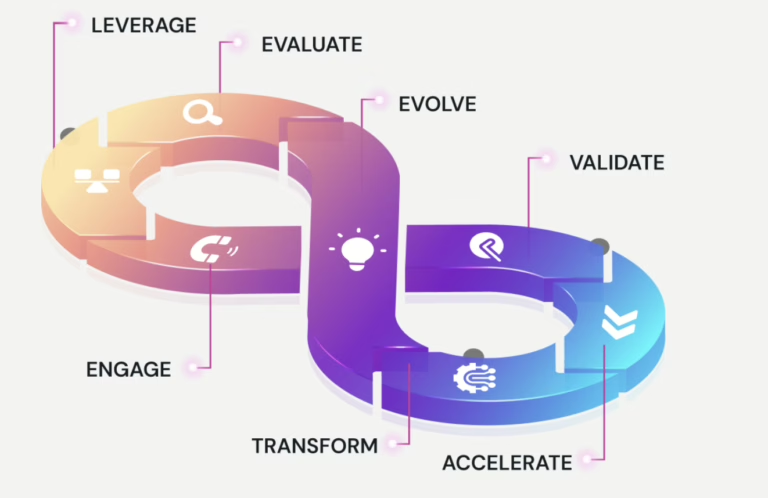

Setting Up Your CSRD Reporting Strategy

Establishing a sound CSRD Reporting strategy begins well before delving into the Double Materiality Assessment and the ESRS. With the first reports due in 2025, based on 2024 data, companies must start preparing their data collection processes and dedicated teams. This involves mapping out essential data points, involving relevant departments in the reporting process, allocating budgetary resources, and defining roles and responsibilities.

According to CSRD Expert Quentin Hennaux, the CSRD provides an opportunity for companies to showcase how their global strategy aligns with ESG matters. Properly embracing the CSRD can help drive meaningful change, foster a sustainable future, and gain a competitive edge in the evolving landscape of responsible business practices. Leveraging this legal requirement can be a significant opportunity for companies.

Conclusion

The implementation timeline of the CSRD was created with careful consideration of the resources available to each type of organization. Mandates for disclosure of ESG-related information under the CSRD will be phased in from 2025 to 2029, tailored to the size of the companies involved. Companies may generate their CSRD report before being required to do so, allowing them to act and improve their sustainability before having to disclose it publicly or on request from third parties.

The CSRD represents a significant shift in the way companies report their sustainability performance, offering a standardized approach to ESG reporting that enhances transparency, comparability, and reliability of the disclosed information. As companies prepare to comply with the new regulations, understanding and leveraging the CSRD can be a powerful catalyst for driving sustainability and gaining a competitive edge in the market.