In Europe, sustainability has evolved from a societal obligation to a core strategic priority for large corporations. Executives increasingly recognize its significance, with studies highlighting that 33% of companies consider the CEO’s vision as the primary driver for sustainability commitments.

Emerging ESG frameworks, such as the Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy, are reshaping the landscape by emphasizing data transparency and comparability. This shift transcends compliance; ESG performance is now a critical determinant in securing future financing opportunities.

While large corporations have incorporated ESG, many SMEs still need to be made aware of its importance. Only a small percentage of SMEs are mandated to comply with standards like the simplified ESRS, Voluntary SME ESRS (VSME), or other ESG reporting frameworks. Most SMEs prioritize day-to-day operations over sustainability reporting, yet initiating ESG strategies early can offer significant long-term benefits.

Defined by staff size, turnover, or balance sheet total, SMEs represent 99% of all EU enterprises and employ nearly 100 million people. From 2026, they listed SMEs that meet criteria such as a balance sheet total of €5 million, a net turnover of €10 million, or 50+ employees will need to comply with the CSRD and EU Taxonomy.

SMEs face several hurdles in adopting ESG practices, including financial constraints, limited expertise, inadequate data, and unclear incentives. However, the benefits of structured ESG strategies outweigh these challenges. A well-defined approach—setting ESG goals, assembling a reporting team, initiating reporting processes, and refining sustainability practices—can position SMEs to turn sustainability into a competitive edge.

While legal mandates currently target listed SMEs, transparency in ESG practices is fast becoming a universal expectation. Adopting proactive sustainability strategies not only aligns with evolving regulations but also unlocks potential advantages in financing, customer loyalty, and market reputation.

So, why are SMEs still hesitant? Let’s explore the challenges that stand in the way and how overcoming them can lead to significant growth.

4 Challenges Faced by SMEs in ESG Reporting

ESG reporting isn’t a walk in the park for small and medium-sized enterprises (SMEs). If you’re one of the brave souls venturing into this space, you’re probably well aware of the hurdles that lie ahead. So, what’s standing in your way? Here’s a look at the challenges that can feel like climbing a mountain without proper gear –

- Budget Limitations: Different from their corporate counterparts with deep pockets, SMEs often need more resources. The costs associated with gathering data, hiring consultants, and implementing tracking tools can feel like a weight dragging you down. It’s a tricky balancing act, and sometimes, it can seem like there’s not enough cash left over for these new initiatives. The fear of allocating funds to something intangible, like sustainability, can also hold SMEs back. Yet, the cost of inaction—lost business opportunities or reputational damage—can end up being far greater in the long run.

- Lack of Expertise: ESG reporting can feel like wandering through a maze – complex and confusing, especially for those who need a guide. Many SMEs find themselves needing more specialized knowledge to tackle the details of sustainability metrics. You might know your business inside out, but when it comes to compliance and data collection, it can feel like you’re trying to solve a puzzle without all the pieces. This knowledge gap can leave you questioning which data is essential and how to meet ever-evolving standards.

- Absence of Data: Imagine wanting to improve your business’s environmental impact but not knowing where to start. For many SMEs, collecting the necessary data is overwhelming. If you don’t have reliable systems in place, gathering relevant information can feel like searching for a needle in a haystack. Without the correct data at your fingertips, creating an effective ESG report can quickly become an uphill battle. This lack of data not only hinders accurate reporting but also makes it challenging to identify areas where meaningful improvements can be made. Without clear insights, even well-intentioned efforts risk falling short of creating a real impact.

- Uncertain Incentives: Investing in ESG reporting can feel like throwing money into a black hole, especially when the immediate benefits aren’t crystal clear. For many small businesses, the lack of legal mandates makes it hard to justify these costs. It’s challenging to invest time and money in something that feels more like a checkbox than a strategic advantage, mainly when the ROI seems uncertain. Without clear financial incentives or regulatory pressure, it’s easy to wonder whether the effort will indeed pay off in the long run. However, businesses that leap can potentially tap into emerging opportunities, from attracting conscious consumers to gaining the trust of investors.

But don’t lose hope! Every challenge presents an opportunity, and by addressing these hurdles head-on, SMEs can not only survive but thrive in the world of ESG.

Why ESG Reporting Matters More Than Ever for SMEs?

The challenges of ESG reporting may be accurate, but the reasons for embracing it are just as powerful. Small businesses are the backbone of economies worldwide, and by investing in sustainability, they’re not only contributing to a healthier planet but also securing their place in the future marketplace. The ability to attract customers, investors, and even top talent increasingly hinges on a business’s commitment to sustainability and transparency.

While it’s easy to see ESG as a burden, it’s also an opportunity to set yourself apart in a competitive landscape. Every small step taken toward sustainability can create a ripple effect, boosting your reputation, strengthening stakeholder trust, and giving you a leg up in a world that’s moving steadily toward more ethical and responsible business practices.

In the end, ESG reporting is less about checking boxes and more about forging a path forward in a changing world. And for SMEs willing to take that leap, the rewards—though perhaps not instant—are well worth the journey.

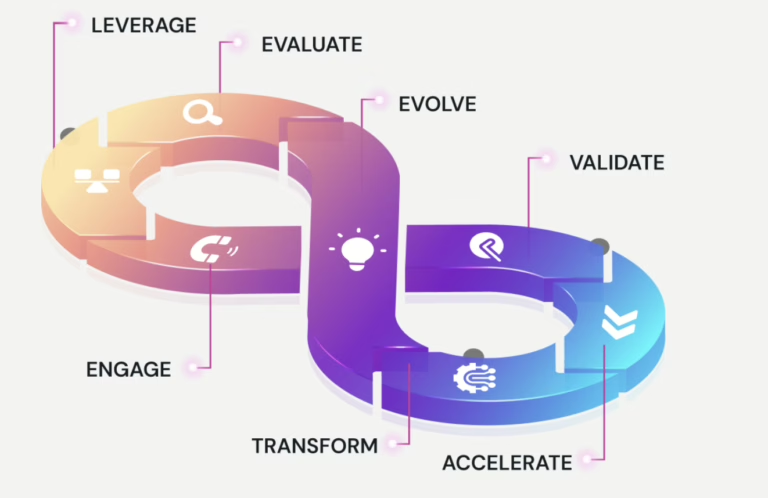

47Billion supports SMEs in this journey with end-to-end solutions, including automated ESG data collection and AI-driven recommendations, empowering businesses of all sizes to lead in the sustainability revolution