In boardrooms and break rooms alike, a quiet transformation is underway.

ESG has become a focus are for all. It’s the lens through which stakeholders now judge trustworthiness, resilience, and long-term value.

But behind the ESG reports lies a far more challenging reality. Sustainability teams get through scattered data from dozens of systems. Finance, HR, and operations operate in silos. Regulatory frameworks evolve faster than teams can respond. Reports are outdated the moment they’re published.

For many companies, ESG reporting feels like trying to assemble a puzzle while the pieces keep changing shape.

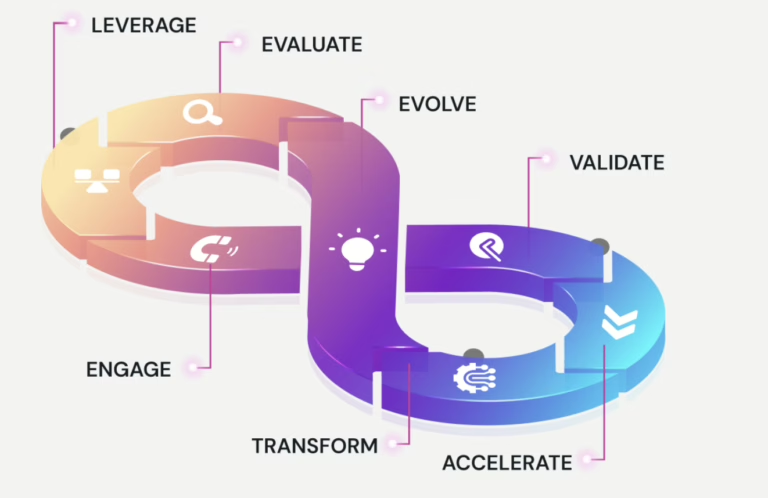

This is where AI agents enter the story—not as a new tech gimmick, but as quiet revolutionaries. These intelligent, autonomous digital workers are rewriting the rules of ESG reporting. They move through systems, stitch together fragmented data, catch inconsistencies, monitor regulations, and even forecast risks before they arrive.

In the chapters ahead, we’ll explore how AI agents are shifting ESG from reactive obligation to proactive advantage—turning sustainability into a strategic, real-time, and deeply integrated business function.

The Existing Scenario

Before we dive into what AI agents solve, let’s look at what the ESG reporting landscape looks like without them –

- Manual Data Entry: Sustainability officers spend weeks manually pulling data from spreadsheets, vendor reports, and ERP systems.

- Lack of Integration: Data lives in silos—HR systems, supply chain tools, IoT devices, and financial software rarely speak to each other.

- Static Reports: ESG reports are typically compiled quarterly or annually, leading to outdated insights.

- Compliance Complexity: Navigating frameworks like CSRD, GRI, SASB, and TCFD requires deep manual effort.

- Limited Benchmarking: Few companies can benchmark their ESG performance against peers in real time.

- High Costs: Dedicated teams are required to coordinate reporting, audits, and updates.

In this outdated model, organizations fall behind both on transparency and impact.

The Problems AI Agents Are Resolving

AI agents tackle the core bottlenecks in ESG reporting:

| Traditional Challenges | How AI Agents Solve Them |

| Disconnected data from multiple sources | Automate data extraction and harmonization across platforms and geographies |

| Manual errors in data entry and validation | Use rule-based engines and ML to validate, cleanse, and normalize data in real-time |

| Delayed reporting cycles | Enable continuous ESG tracking and dynamic dashboards |

| Complex and ever-changing regulatory frameworks | Track global ESG frameworks and update internal logic automatically |

| Subjectivity in materiality assessment | Use NLP to analyze news, stakeholder sentiment, and disclosures to refine materiality maps |

| Lack of actionable insights | Deliver predictive analytics and recommendations to guide sustainability strategies |

Key Applications of AI Agents in ESG Reporting

Here are some major applications of AI agents that are currently reshaping ESG processes:

1. Automated Emissions Tracking (Scope 1, 2, and 3)

- AI agents integrate with IoT devices and vendor platforms to gather emissions data

- Automatically calculate carbon equivalents and flag anomalies

2. ESG Framework Alignment & Mapping

- Agents interpret data and match it to multiple frameworks like CSRD, GRI, and SASB simultaneously

- Supports region-specific disclosures without manual rework

3. Materiality Analysis

- Analyze stakeholder sentiment, news, regulatory alerts, and internal risks

- Dynamically update what’s “material” for the organization

4. Supplier Sustainability Evaluation

- Agents score suppliers based on ESG risk, compliance history, and emissions footprint

- Recommend sustainable alternatives or identify red flags

5. AI-Generated Reporting

- Auto-draft sustainability reports, executive summaries, and board presentations

- Tailor messaging to investors, regulators, or customers using generative AI capabilities.

6. Real-Time Dashboards & Scenario Modeling

- Visualize current ESG performance

- Run impact simulations (e.g., “What if we switch to renewable sourcing?”)

How AI Agents Improve ESG Reporting Across Geographies?

AI agents are especially valuable in multinational contexts, where:

- Regulatory environments vary by country: AI agents can customize reporting logic based on regional frameworks (e.g., CSRD in EU, SEBI BRSR in India, SEC rules in the US)

- Language localization is required: NLP models can translate and summarize ESG information in local languages

- Data fragmentation is higher: Different branches may use different systems—AI agents normalize data across all of them

- Comparative performance tracking is essential: AI agents benchmark locations against regional competitors or standards

- Climate and social risks vary: Agents assess local vulnerability (e.g., flood risk, labor risk) using geo-tagged data

These use cases illustrate how a unified ESG strategy, powered by AI, can scale globally. See how 47Billion’s ESG solutions help enterprises navigate this complexity effortlessly.

Benefits of AI-Driven ESG Reporting

| Benefit | Impact |

| Speed & Efficiency | Reporting cycles shrink from months to days |

| Accuracy & Trust | Clean, validated data improves auditability and investor confidence |

| Scalability | AI agents handle growing regulatory, geographic, and data complexities |

| Proactivity | Identify ESG risks before they materialize |

| Transparency | Improve brand reputation with open, defensible disclosures |

| Cost Reduction | Reduce manual effort and compliance-related penalties |

Case in Point: AI Agents in Action

A European energy firm adopted AI agents to automate ESG data capture from over 100 facilities. These agents calculated Scope 1, 2, and 3 emissions, aligned them with EU taxonomy, and auto-generated board-level reports. The result?

- 40% reduction in compliance cost

- Monthly ESG insights instead of quarterly reports

- Enhanced stakeholder trust via transparent tracking

Key Considerations Before Integration

- Data readiness: Ensure structured, centralized data systems

- Framework prioritization: Choose primary ESG standards to guide implementation

- Change management: Bring finance, operations, IT, and ESG teams together

- Transparency controls: Ensure AI outputs are traceable and explainable

- Tool selection: Pick ESG platforms with in-built AI capabilities (e.g., C3 AI ESG, Credibl, CodeGaia)

Future Outlook: From Reporting to Strategy

AI agents are evolving beyond compliance into strategic ESG co-pilots. Soon, they’ll be able to:

- Suggest sustainability initiatives based on global ESG intelligence

- Simulate investment impacts on carbon footprint and community development

- Propose energy-efficient process optimizations

- Personalize ESG communications for investors, regulators, and consumers

As regulations tighten and climate urgency grows, companies that adopt AI agents now will lead the ESG narrative tomorrow.

Conclusion

AI agents aren’t here to replace sustainability leaders—they’re here to empower them. By offloading routine tasks and amplifying analytical power, these agents are reshaping ESG from a burden to a competitive advantage. The future of ESG isn’t just about reporting—it’s about intelligent, actionable, real-time decision-making.

Are you ready to elevate your ESG strategy with intelligent automation? Let’s talk about how our AI agent-powered platform can simplify, scale, and strengthen your ESG outcomes.