It is 2030. John has hailed an autonomous cab. He leaves for the office in his self-driving cab. John’s AI assistant maps a potential route and shares it with his mobility insurer, which instantly finds another optimal route that has less probability of accidents and provides information regarding adjustments or additions in his monthly premium if there is any damage.

When John pulls into his office parking lot, his car bumps into one of the parking signs.

As soon as the car stopped working the automatic control determined the extent of the damage. His AI assistant gave him instructions for taking pictures of damage and surroundings. There is a notification on his mobile from his insurance company. It stated that his claim has been approved.

This scenario may seem beyond the horizon, but such use cases are going to emerge across all the domains of insurance. Using deep learning techniques, AI can shift the Insurance industry from detection and repair to prediction and prevention.

From transforming processes with the perspective of customer satisfaction to optimizing back-office processes, insurers are today striving to make claims processing faster and simpler.

Here are the innovations that are taking place in the insurance industry –

Automated Claims Management

Implementation of AI and ML models can define the unknown characteristics of the claim such as the likelihood of fraud, total loss, or litigation to speed up case handling. For example, a European insurance carrier, improved its fraud detection by up to 18 percent by using an AI-based system. Also, leading automotive insurers can calculate damage based on real-time pictures of vehicle damage with the help of picture recognition techniques.

Automated Support

Claims chatbots are helping in improving the current status of claim processing. It removes excessive human intervention and reports the claim reviews the claim, verifies policy details, applies fraud detection checks, captures damage, updates the system, communicates with the customers, and shares instructions with the bank to pay for claim settlement all by itself.

The automated claim support system releases companies from expensive fraudulent claims, and human errors and also helps in eradicating inaccuracies by identifying data patterns in claim reports.

AI-aided Underwriting

Smart IoT devices are accumulating a lot of valuable information which can be further utilized to make the process of insurance premium regulated. For example, fitness trackers and vehicle tracking devices help both health and auto insurance sectors to develop dynamic underwriting algorithms that control premium dictation.

Automated Settlement

NLP, document and receipt scanning, multilingual audio and video transcription, and ML models are helpful for loss classification. Digitization in the claims journey improves the experience for customers and provides greater efficiency by reducing the practice of manual claims handling.

Prevention rather than cure

Insurance companies are providing personalized training to prevent accidents and proactive preventative health services to reduce the burden of upcoming claims. The trend is towards providing 360 degrees of quality of service for the long-term safety of vehicles and people rather than insuring just unexpected events.

Conclusion

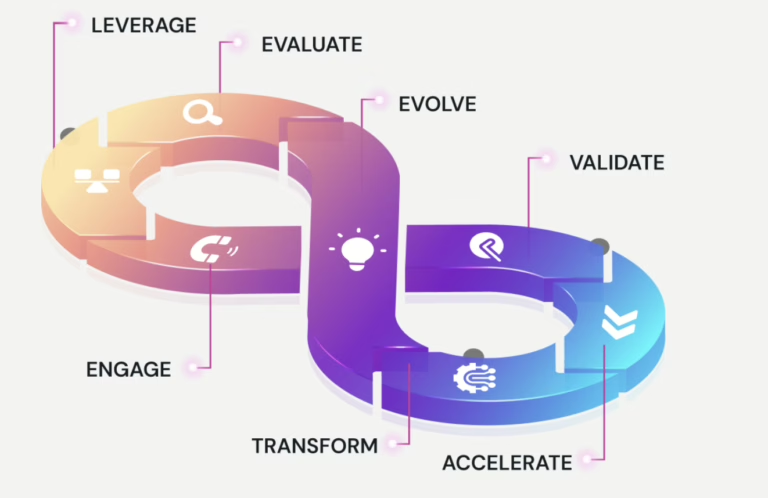

Insurance companies today, are required to devise an enterprise strategy, to implement AI in a way that offers more than just a customer experience.

At our workplace we are in process of implementing multiple applications of AI in the Insurance Industry whether it is claims management, claims settlement, or eSigning. By working on smart automation of workflows we assure less resource consumption, increased process efficiency, and enhanced customer experience.