Today, there’s a growing buzz around Environmental, Social, and Governance (ESG) reporting, and it’s not just for the big players anymore. While mega-corporations have already adopted sustainability as a core strategy, small and medium-sized enterprises (SMEs) often find themselves asking, “Does this really matter to us?”

Well, it absolutely does. Your customers, investors, and even your bank are no longer just interested in what you sell—they’re paying close attention to how you operate. Whether you’re running a small family business or a fast-moving startup, the world is looking for more than just profits; they want accountability, transparency, and purpose.

ESG isn’t just a nice-to-have anymore – it’s becoming the key to building trust and staying ahead of the game. So, if you think ESG is just for the corporate giants, it’s time to rethink.

Let’s break down why ESG reporting should be on your radar, the hurdles that come with it, and how forward-thinking SMEs can turn this into their secret weapon for growth.

Why is ESG reporting important for SMEs?

Small and medium-sized enterprises (SMEs) are the backbone of the European economy. They make up 99% of all businesses and employ nearly 100 million people. But here’s the twist: while these businesses might not always get the spotlight, they play a crucial role in shaping both the environment and society. And even though ESG reporting isn’t yet important legally for non-listed SMEs, the pressure is mounting from investors, banks, and customers who want to know: what’s your sustainability story?

This isn’t just some trendy phase that’s going to fade out – it’s the future. As the financial world and consumers invest more in sustainability, the SMEs that start paying attention to ESG will reap serious rewards. Think about cheaper financing, the chance to hook eco-conscious customers, and the ability to land deals with larger companies that are tightening the screws on their supply chains to ensure they’re sustainable.

And let’s not forget what’s coming by 2026, listed SMEs in the EU will have to comply with the Corporate Sustainability Reporting Directive (CSRD). Even if your business isn’t listed, you’ll feel the ripple effect as your partners and stakeholders push you to meet their sustainability expectations. So, the question isn’t whether SMEs should care about ESG – the question is, can you afford not to?

The Indirect Impact of CSRD on SMEs

Even if your small business does not technically comply with the Corporate Sustainability Reporting Directive (CSRD) today, you’re not off the hook. The wave of sustainability is coming for everyone, and you won’t want to be caught off guard. Big corporations are now under pressure to hit strict ESG targets, and guess who they’re looking at to help them? Their suppliers are often smaller businesses like yours.

Banks and investors are also waking up to this new reality. They’re factoring in ESG risks when deciding whether or not to back an SME. So, if you’re trying to secure capital, your green and social credentials might soon be just as important as your business plan.

Just imagine you run a catering business, and one of your big corporate clients decides they’re going all-in on zero-waste policies. If you can’t keep up with their sustainability standards, that contract could slip right through your fingers. The same goes for investors and banks—those that prioritize sustainability are more likely to pour their money into businesses doing their part for the planet.

The market is changing, and if you’re ahead of the curve on ESG reporting, you won’t just survive; you’ll set the pace.

What Can SMEs Expect from ESG Reporting?

As the world leans harder into sustainability, SMEs can no longer stay on the sidelines. The spotlight is growing, and your business will likely find itself fielding requests for ESG data from all sides. Customers, banks, investors, even local authorities – everyone wants to know what you’re doing for the planet, your people, and your governance practices. But here’s the tricky part – they’ll each want different information, often presented in their own unique and sometimes frustratingly confusing format.

So, what should you be ready for? Let’s break it down:

1. Sustainability Policies: First things first – what’s your game plan? Stakeholders want to see the tangible steps your business is taking to tackle environmental, social, and governance issues. Whether it’s reducing your carbon footprint or improving employee well-being, it’s about proving you’re not just making promises but actually following through with real action.

2. Principal Adverse Impacts: No business is perfect, and everyone knows it. But what matters is how upfront you are about your negative impacts. Whether it’s energy consumption, waste generation, or how your supply chain affects the environment, being honest about the downsides and what you’re doing to address them is crucial.

3. ESG Risks: Every business faces risks, but how well are you prepared for those tied to ESG? This means evaluating threats to your business that stem from regulatory changes, environmental hazards, or social pressures and showing how you’re staying ahead of them.

4. KPIs (Key Performance Indicators): Numbers speak louder than words, and when it comes to ESG, they’re essential. Stakeholders will want to see hard data on things like carbon emissions, how much waste you’ve cut down, or even social metrics like diversity in your workforce. This is where you really start to measure progress.

Are you feeling overwhelmed? That’s understandable, especially if you’re a small team juggling a million other tasks. But there’s good news: newer frameworks are being built specifically for businesses like yours. Think of it as a simplified toolkit, with options like the EU Taxonomy’s scaled-down version or the SME-specific European Sustainability Reporting Standards (ESRS). These tools are designed to help you manage reporting without driving you up the wall. The road ahead might look daunting, but with the right resources, it’s a path you can definitely follow.

How Can SMEs Get Started with ESG Reporting?

Leaping into ESG reporting may feel like stepping into unknown territory, but don’t let the challenges intimidate you! The benefits far outweigh any bumps in the road, and the first step is to see ESG not as a burden but as a ticket to building a thriving, adaptable company in a constantly changing environment.

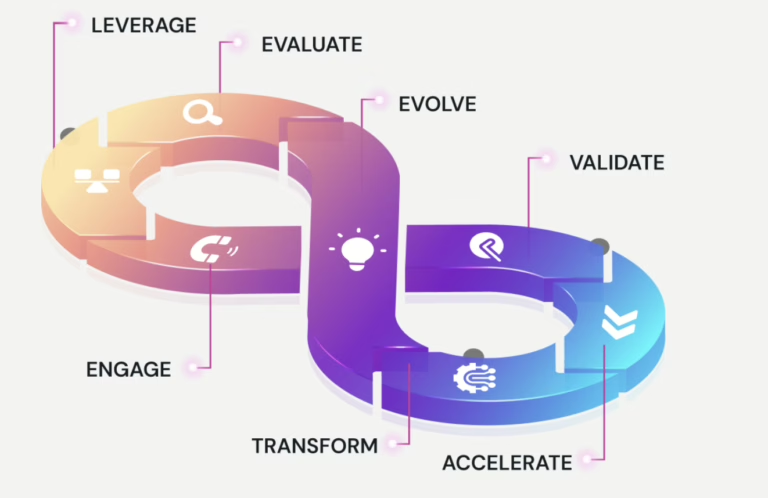

Start by exploring what sustainability means to you and your organization. Align your sustainability aspirations with your business goals and identify the significant impacts your operations have on the environment and society. Once you have that clarity, think about what you’ll need to turn those aspirations into reality – whether that’s investing in staff training, software tools, or bringing in expert guidance.

Even with a small team, you can assemble a powerhouse of ESG champions from different departments. Empower them with knowledge and let them lead the charge. As you begin gathering data on your operations, remember that this isn’t just about checking boxes; it’s about an ongoing journey toward sustainability. Look for ways to innovate – reduce waste, ramp up energy efficiency, and explore exciting green initiatives like solar energy. The journey may be challenging, but the rewards will propel your company into a brighter, sustainable future.

Are you ready to start your ESG journey? Contact our team of experts at 47Billion to discuss how we can support small and large businesses in their sustainability efforts. Join us in shaping your ESG reporting strategy and turning sustainability into a key driver of growth and resilience for your business – connect today to get started!