Remember when banking meant standing in long lines, filling out paperwork by hand, and dealing with tellers who only knew you by the numbers on your account? It’s incredible how much things have changed. Today, banks are all about making life easier for us. From alerts that protect us against fraud in real-time to loan offers that seem customized just for us, it’s like they’re reading our minds. And while this transformation might sound complex, it really comes down to one thing – advanced analytics.

But here’s the exciting part – advanced analytics is more than numbers and algorithms; it’s about banks getting smarter so they can support our unique financial journeys. It’s all about learning from our habits and needs to offer the services we actually want. Picture your bank not as a place that just holds your money but as a partner, helping you reach your financial goals faster and with fewer headaches. Let’s explore how advanced analytics is putting us, the actual customers, at the heart of banking, making it more personal, secure, and seamless than ever before.

The Banking World Has Shifted – And You’re in the Driver’s Seat

The banking landscape has transformed dramatically. Now, when you open your banking app, you’re greeted not by the same old interface but by personalized savings plans designed for your dream vacation or retirement goals. This shows how advanced analytics puts you in control of your financial future, as banks use your spending habits and income patterns to offer helpful solutions even before you realize you need them.

Banks are now using technology to really understand your spending habits, income patterns, and even the little financial choices you make every day. They can predict what you need before you even think about asking for it.

It’s like how Netflix knows what shows you’d love or how Spotify curates’ playlists just for you. These insights don’t feel like an invasion of privacy; they feel like a helpful nudge from a trusted friend. Banks are transforming from mere money storage places into partners in your financial journey, dedicated to helping you reach your goals and live your best life.

Say Goodbye to Waiting and Hello to Real-Time Solutions

We’ve all experienced that sinking feeling while waiting for a bank to approve a loan, resolve an issue, or confirm a suspicious transaction. It’s like watching paint dry! But guess what? With advanced analytics, those frustrating waits are becoming a thing of the past.

Imagine you spot a strange charge on your card from a country you’ve never set foot in. In the old days, you might only catch it when your monthly statement arrives—too late! Now, banks use real-time analytics to flag that charge instantly, sending you a notification to confirm if it’s legitimate. Talk about peace of mind.

And it gets better. When you apply for a loan, banks can assess your creditworthiness on the spot. No more nail-biting waits for days on end! You could get approval in mere minutes. This speedy process not only makes banking simpler but also lets you focus on what truly matters – chasing your dreams instead of drowning in paperwork. Say hello to a more innovative, faster banking experience.

Data That Works for You, Not Against You

We all value our privacy, especially when it comes to our financial data. But the good part is that advanced analytics in banking isn’t about prying into your life; it’s about creating a more effective banking experience without compromising your security. Thanks to regulations like GDPR, banks are committed to handling your data responsibly, ensuring you stay in control while they leverage insights to serve you better.

Consider that advanced analytics empowers you to make smarter financial decisions. Imagine your banking app as your financial coach, offering customized insights into your spending, savings, and investments. Want to buy your dream home? Your bank can analyze your spending patterns and give you practical, personalized tips on how to reach that goal faster—whether it’s pinpointing areas to cut back on or advising how much to save each month. No more generic solutions; instead, you receive specific strategies that fit your unique financial journey.

Banking for Everyone: Simplified, Adaptable & Future-ready

A banking experience that goes beyond simple transactions and is designed to make your financial life smoother, no matter who you are or where you’re at in your journey, now feels like a dream come true. Advanced analytics is bringing that vision to life. For first-time account holders and seasoned investors alike, banking is evolving, becoming smarter and more adaptable to the world’s ever-changing financial landscape.

Think about how frustrating it used to be when banks fell one step behind during economic downturns or market shifts. Today, with advanced analytics, banks can anticipate changes and respond in real time, ensuring that their products stay relevant and valuable no matter what’s happening globally. They’re streamlining processes, cutting down paperwork, and using data to manage risk more effectively than ever.

Whether you’re planning for retirement, managing everyday expenses, or exploring investment opportunities, advanced analytics means your bank is there, ready to support you with options that fit the times—giving you peace of mind through every change.

Real-Life, Real-Time Support Just for You

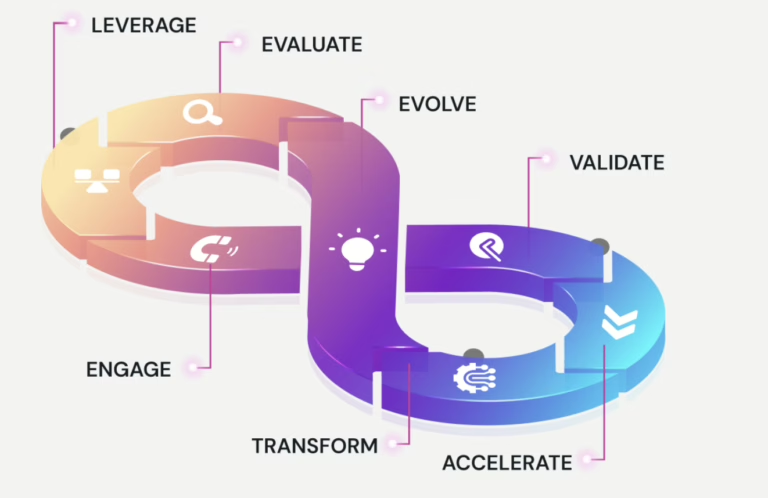

Today, banking is no longer just about storing money; it’s about creating a financial experience that’s truly tailored to you. Advanced analytics is leading this transformation, turning banks into proactive partners that help you manage finances with greater ease, security, and insight. From personalized savings plans to real-time fraud alerts, this technology makes banking more responsive and relevant to your unique needs.

With each recommendation, your bank is not only keeping your financial journey on track but also ensuring that your assets are protected and your goals supported. It’s a new era where financial institutions go beyond transactions, stepping up as partners in your success.

Ready to harness the power of advanced analytics for a smarter, more intuitive banking experience? At 47Billion, we’re here to help you every step of the way. Reach out to us today, and let’s create banking solutions that truly work for you.