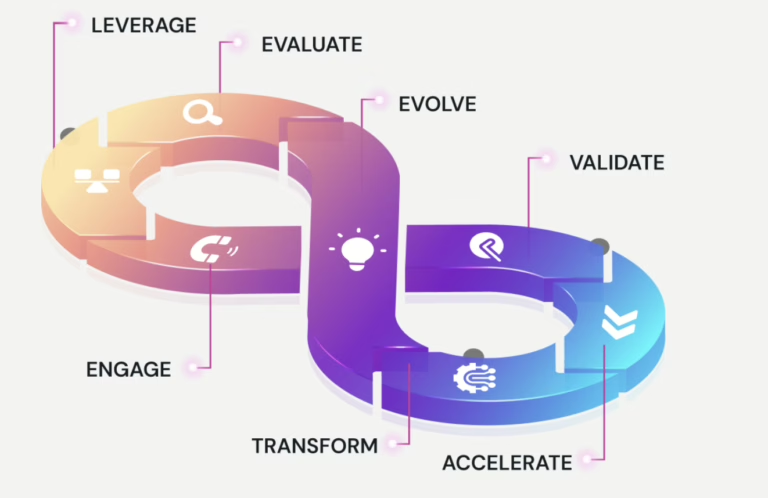

Automation makes financial operations faster, but agentic workflows make them intelligent. Agentic workflows powered by autonomous AI Agents represent a shift from rule-based automation to goal-driven orchestrations. These agents perceive context and reason through ambiguity and collaborate across systems to deliver outcomes in real time.

They connect data pipelines, reasoning engines, and governance frameworks into a self-learning mesh of decision intelligence, where strategy, operations, and compliance coevolve dynamically.

For leadership, this evolution is about complete re-architecture of the enterprise operating model. Here human leadership, AI autonomy, and governance co-exist.

Strategic Context

Traditional automation is about improving efficiency, but it is reactive; systems wait for inputs, trigger actions, and acts when exceptions occur.

Agentic workflows are proactive, adaptive, and contextually intelligent.

They integrate four core layers of intelligence –

| Layer | Function | Technology Stack |

| Perception Layer | Ingests structured/unstructured data across systems (core banking, CRM, risk engines, market APIs). | Data lakes, vector databases, event streaming, APIs |

| Reasoning Layer | Uses LLMs, knowledge graphs, and probabilistic models to derive meaning and intent. | LLM fine-tuning, RAG pipelines, ontology-based reasoning |

| Orchestration Layer | Coordinates multi-agent collaboration across departments or workflows. | Agent frameworks (LangGraph, AutoGen, CrewAI), event brokers, workflow orchestrators |

| Learning Layer | Continuously refines decision policies based on feedback loops. | Reinforcement learning, feedback scoring, model retraining pipelines |

Why this matters now:

- AI maturity: Reasoning engines and LLMs can now interpret compliance logic, risk scenarios, and customer intent.

- Data readiness: APIs, data fabrics, and unified data lakes enable real-time multi-domain access.

- Regulatory evolution: AI governance frameworks (e.g., EU AI Act, NIST AI RMF) create space for safe experimentation.

Board-level alignment:

Cost efficiency through autonomous optimization

Agility via real-time contextual decisioning

Compliance with auditable AI traceability

Customer-centricity through adaptive personalization

2. Operating Model Disruption: The End of Hierarchies as We Know Them

Financial institutions were built for predictability, layered hierarchies, sequenced approvals, and rule-based workflows.

Agentic systems thrive in complexity, where conditions change faster than governance cycles.

| Legacy Model | Agentic Model |

| Manual, hierarchical approvals | Decentralized, autonomous decision nodes |

| Siloed business units | Cross-functional agent orchestration |

| Static process maps | Dynamic, context-driven task execution |

| Reactive risk and compliance | Continuous sensing and preemptive remediation |

Under the hood:

Agentic workflows are built as distributed decision networks. Each agent has:

- A local memory (context + recent events)

- A global memory (shared enterprise knowledge base)

- An execution policy (defined by compliance, logic, and objectives)

- Communication protocols (API calls, message queues, or graph-based reasoning links)

Agents interact through event-driven architecture, pushing updates, triggering other agents, or escalating to human review when confidence thresholds drop.

This creates adaptive governance, not a chain of approvals, but a lattice of decision intelligence, where accountability is defined by traceable agent logs and explainable outputs.

3. Business Impact Areas (Technically Amplified)

Revenue Growth

- Multi-agent systems can co-orchestrate cross-selling, combining insights from behavioral AI, CRM data, and market trends.

- LLM-based reasoning can generate dynamic credit recommendations or personalized investment strategies.

- Agents simulate product pricing scenarios in real time using predictive modeling and reinforcement learning.

Cost Optimization

- Cognitive agents automate data reconciliation, KYC, loan underwriting, and compliance reporting by understanding document context via NLP.

- Event-driven orchestration eliminates wait states between departments, achieving parallel process execution instead of sequential handoffs.

Risk & Compliance

- Agents perform continuous transaction scanning, using unsupervised anomaly detection and knowledge graph reasoning.

- AI-generated compliance reports integrate structured and unstructured audit data, reducing reporting cycles from weeks to hours.

- Policy-bound agents ensure every decision remains explainable and within predefined risk of tolerances.

Customer Experience

- Intelligent agents interpret sentiment, transaction history, and intent, enabling predictive service at scale.

- Multi-channel orchestration (voice, chat, email, app) ensures consistent experience through shared context memory.

- Adaptive dialogue management enables the system to learn from each customer touchpoint, improving satisfaction over time.

4. Leadership Considerations: Redefining What It Means to Lead

In an agentic enterprise, leadership shifts from command to coordination of intelligence.

| Role | Evolved Responsibility |

| CEO | Align AI autonomy with enterprise ethics, vision, and governance |

| CFO | Move from backward-looking reporting to predictive, real-time forecasting |

| COO | Balance AI-human collaboration, ensuring resilience and adaptability |

| CIO/CTO | Architect the agentic backbone, a secure, interoperable ecosystem of APIs, LLMs, and data layers |

| Chief Transformation Officer | Lead cultural and talent transformation for AI interpretability and supervision |

Leadership imperatives include:

- Define decision boundaries (when agents can act vs. when to escalate.

- Establish observability frameworks (logs, dashboards, explainability indices).

- Enable continuous learning systems with bias detection and model performance scoring.

Talent strategy also evolves, human teams must interpret AI recommendations, perform ethical audits, and supervise agentic decision paths.

5. Strategic Questions Every Leader Should Be Asking

- Which domains – KYC, claims, credit, fraud, portfolio risk can safely host pilot agentic workflows?

- How will decision traceability be enforced across autonomous systems?

- What guardrails will define autonomy levels and escalation triggers?

- How do we measure success, through adaptability, decision accuracy, or time-to-resolution?

- How will we integrate explainability and compliance into AI-driven governance dashboards?

6. The Call to Action: Designing the Agentic-Ready Enterprise

Leaders can begin by:

- Building a cross-functional task force for agentic readiness (tech, risk, ops, compliance).

- Launching a sandbox pilot in low-risk, high-volume areas such as reconciliation or onboarding.

- Redesigning digital transformation roadmaps to position agentic workflows as a foundational operating layer.

- Establishing a governance fabric that ensures every autonomous decision is observable, explainable, and aligned with institutional goals.

The agentic era isn’t about replacing humans, it’s about creating institutions that can reason, adapt, and evolve continuously.

Those who master the orchestration of human and machine intelligence won’t just optimize they’ll outthink the market.

Because the future of finance won’t be automated.

It will be orchestrated.