Over the past decade, fintech has evolved from a disruptive newcomer to a driving force in global financial services. Rapid digitization, shifting customer expectations, and increasing regulatory support have fueled this transformation, reshaping the financial landscape with innovative, customer-centric solutions. While fintech funding and market capitalization surged throughout the 2010s—reaching unprecedented highs in 2021—a market correction in 2022 tempered the explosive growth. Today, fintech is entering a new era of value creation, moving from aggressive expansion to strategic and sustainable innovation.

This shift presents an opportunity to harness AI-driven financial technologies to create meaningful, inclusive, and future-proof solutions. The next phase—Fintech 4.0—is about leveraging AI and machine learning to bridge financial gaps, ensuring that banking, lending, and investment services are accessible to all. As the industry adapts to new economic realities, fintech firms that focus on AI-powered inclusion and strategic scaling will be in charge of redefining financial services.

Let’s explore the powerful intersection of AI and fintech, diving into its current applications, benefits for businesses, and how it is reshaping the future of finance.

The Current State of AI in Fintech

The fintech industry has experienced remarkable growth, much of it driven by AI. According to recent statistics, the global fintech market is currently valued at $340.1 billion, with the market value of AI in fintech alone estimated at $44.08 billion. With a projected compound annual growth rate (CAGR) of 2.9%, AI’s share in fintech is expected to reach $50 billion over the next five years.

AI adoption in fintech is widespread, with 72% of companies utilizing AI in at least one business function. This adoption has led to significant improvements in key areas such as data processing, security management, and customer service.

Additionally, a majority (67%) of organizations plan to increase their spending on AI and data technologies, signaling that AI will play a critical role in the future of fintech. AI-driven automation in processes like identity verification is projected to save banks $900 million in operational costs and reduce millions of hours from onboarding processes.

AI-powered solutions such as chatbots and virtual assistants are also on the rise. These solutions help fintech companies reduce costs by up to 80% while improving customer interaction accuracy. The integration of AI in fintech not only enhances operational efficiency but also enables hyper-personalized financial services, transforming how businesses and customers interact with financial institutions.

AI is not just an addition to fintech; it is the driving force behind its evolution. From predictive analytics to AI-driven customer service and fraud detection, the applications of AI in fintech are vast and impactful. As the industry continues to evolve, financial institutions that integrate AI into their operations will remain ahead of the curve, offering more efficient, secure, and personalized financial services.

As we look forward to the future, AI’s role in fintech will only expand, further transforming the industry and setting new benchmarks for innovation and customer experience.

We believe in shaping the future of fintech by leveraging cutting-edge technologies to drive financial inclusion. The fintech industry has undergone significant transformation, evolving from Fintech 1.0, which focused on payments, to Fintech 2.0, which explored blockchain.

Now, Fintech 3.0 is all about inclusion—leveraging AI and machine learning to create financial solutions that serve underserved populations.

AI-Powered Financial Inclusion

Artificial intelligence is revolutionizing fintech, breaking down barriers to financial access. Companies are using AI-driven models to provide fair and inclusive mortgage lending, eliminating biases that have historically excluded certain communities. These technologies ensure that lending decisions are based on financial data rather than outdated redlining practices.

Meanwhile, customer service AI solutions are removing language and geographic barriers, enabling banks to serve a more diverse audience. By utilizing AI-powered chatbots and personalized financial assistants, institutions can ensure that financial literacy and services reach more people, regardless of their background.

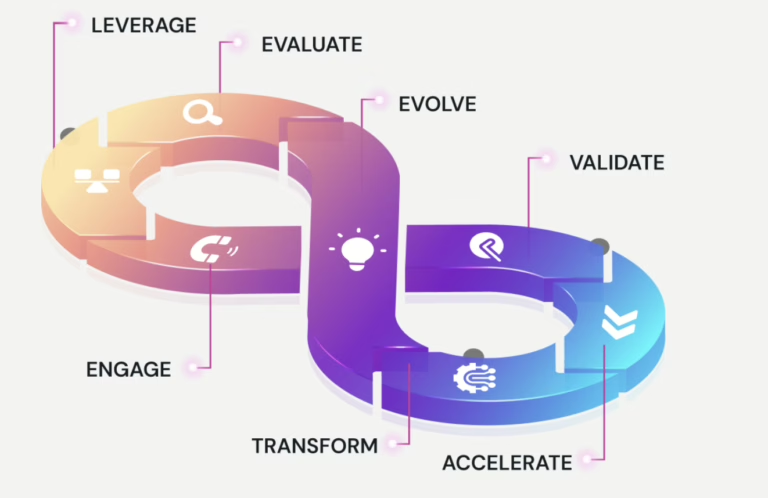

Achieving Network Effects in Fintech

One of the biggest challenges in fintech adoption has been achieving network effects—where the value of a financial tool increases as more people use it. To drive broader adoption, fintech firms can leverage local influencers and community networks to build trust and encourage participation.

By tapping into geographically targeted influencer networks, fintech companies can enhance accessibility and increase engagement within niche communities. This strategy ensures that financial tools designed for inclusion are widely adopted, creating a positive feedback loop that strengthens financial ecosystems.

The New Way Forward in Fintech

With the rise of mobile-first solutions, financial technology is becoming more accessible than ever before. However, challenges remain, including the gender divide in digital financial services.

Key strategies to move fintech forward include:

- Investing in digital infrastructure to expand internet access and mobile banking capabilities.

- Simplifying regulatory procedures to make it easier for individuals to access financial services.

- Promoting financial education to ensure people can safely and effectively use digital financial tools.

Top Applications of AI in Fintech

AI’s ability to process and analyze vast amounts of data has led to several practical applications in fintech. Here are some of the most impactful ways AI is transforming the industry today:

1. Data Processing and Quality Management

Financial institutions handle vast amounts of data daily, and ensuring its accuracy is crucial. AI and machine learning (ML) tools help automate data quality management by identifying patterns, flagging anomalies, and correcting errors in real time. This streamlines data processing, ensuring that financial institutions maintain accurate and reliable information while reducing the cost of errors.

2. AI-Assisted Document Search

Many financial institutions face challenges in navigating extensive documentation. AI-assisted document search leverages natural language processing (NLP) to streamline the retrieval of relevant information. By enabling quick and precise access to documents, organizations can enhance decision-making processes and improve compliance adherence.

3. Structured Data Extraction from Unstructured Documents

Financial documents often contain unstructured data, making it difficult to extract actionable insights. AI-powered tools automate the extraction of structured data from unstructured sources, ensuring that critical information is captured accurately and efficiently. This capability not only saves time but also minimizes the risk of compliance issues.

4. Financial Predictive Forecasting

Predictive analytics powered by AI equips financial institutions with the ability to forecast trends, assess risks, and make informed investment decisions. By analyzing historical data and identifying patterns, AI-driven systems can deliver insights that enhance strategic planning and resource allocation.

5. AI-Driven Portfolio Management

AI-driven portfolio management tools help investors optimize their investment strategies by analyzing market trends, individual asset performance, and economic indicators. These tools can suggest real-time adjustments to portfolios, ensuring they remain aligned with investor objectives while mitigating risks.

6. Automated Compliance and Regulatory Filings

The ever-evolving regulatory landscape demands meticulous attention to compliance. AI can automate compliance and regulatory filings, ensuring that organizations meet their obligations without the burden of manual data entry. This automation reduces operational costs and enhances accuracy, allowing teams to focus on higher-value tasks.

7. Automated Financial Reporting

Generating financial reports is a time-consuming task requiring data from various sources. AI models enable financial institutions to automate this process, producing accurate reports faster and more efficiently. These reports can be customized for different stakeholders, providing insights to aid decision-making.

8. AI in Loan Underwriting

AI is revolutionizing the loan underwriting process by analyzing traditional and non-traditional data points, such as credit history and social media behavior. AI algorithms can assess a borrower’s creditworthiness more accurately and faster than traditional methods. This leads to quicker loan approvals and lower costs for financial institutions, with potential cost savings of up to $31 billion in underwriting expenses by 2030.

9. Robotic Process Automation (RPA) in Finance

RPA combines AI and software robots to automate repetitive tasks that once required human intervention. This technology streamlines various financial processes, from transaction processing to regulatory reporting, improving operational efficiency while reducing errors.

10. AI-Powered Customer Service

AI-powered chatbots and virtual assistants are transforming how fintech companies interact with their customers. These systems handle routine inquiries in real-time, providing instant

support across multiple channels. AI chatbots reduce the burden on customer service teams while offering a seamless and efficient customer experience.

11. Fraud Detection and Risk Mitigation

Fraud detection remains one of the most critical concerns for financial institutions. AI-powered systems can analyze vast amounts of data to detect patterns that indicate fraudulent activity, flagging suspicious transactions before they cause harm. By automating this process, AI helps financial institutions stay ahead of increasingly sophisticated fraud attempts.

Shaping the Future of Fintech

At 47Billion, we are committed to driving innovation in fintech by integrating AI, machine learning, and ethical financial practices. Our goal is to make financial services accessible, inclusive, and impactful, ensuring that the next wave of fintech solutions reaches everyone—regardless of socioeconomic status.

Are you ready to be part of the fintech revolution? Let’s connect and shape the future of financial inclusion together – www.47billion.com