As we approach the midpoint of this decade, the financial landscape is undergoing a seismic shift. Emerging trends, such as of AI, underscore the urgent need for reskilling and upskilling among finance professionals to navigate the rapidly evolving macroeconomic environment.

These shifts demand more than just technological adoption; they call for a complete reimagining of how finance functions operate and deliver value.

In this context, organizations must renew their focus on high-quality data, reinvest in building the capabilities of their finance teams, and embrace more agile working models to unlock the full potential of innovations that come with the adoption of AI. The trade-off between cost reduction and increased effectiveness is increasingly recognized as a false choice. Instead, leading finance departments are redefining enterprise value creation by lowering absolute costs while reallocating resources to higher-value activities.

Recent analyses of finance functions across industries reveal striking insights: over the past decade, finance organizations have reduced costs by an average of 29%, while leaders in the field have simultaneously shifted 19% more time towards value-added activities. These “finance leaders” demonstrate that operational efficiency and strategic impact can coexist.

In this blog, we explore imperatives that are driving transformation in finance in 2025: expanding efficiency opportunities beyond transactional activities, strengthening data management, integrating advanced analytics and decision-making tools, and reimagining the finance operating model to nurture new skills.

These imperatives offer a clear roadmap for organizations aspiring to join the ranks of finance-function leaders, enabling them to cut costs, improve data quality, and guide enterprise-wide decision-making.

The future of finance isn’t just about keeping pace with change—it’s about leading it. Let’s dive into the strategies and insights shaping the financial outlook for 2025.

1. Revolutionizing Finance with Agile Operating Models

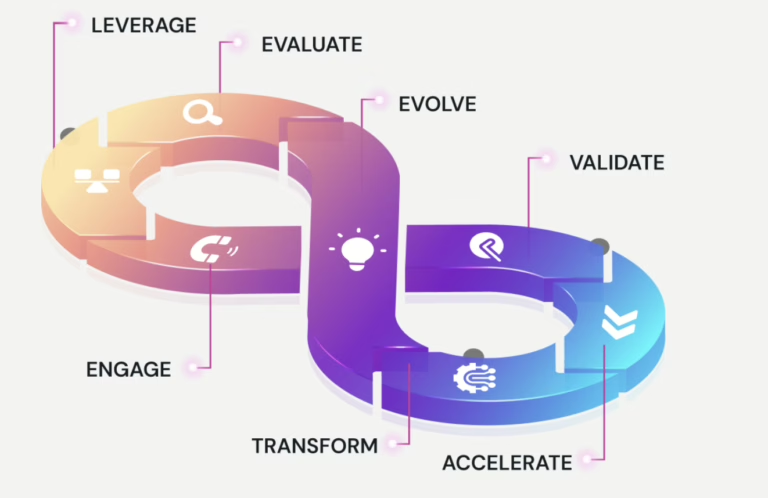

The traditional finance operating model is undergoing a major change. Organizations are moving away from rigid hierarchies and toward dynamic, networked structures that prioritize speed and flexibility. Key features of this transformation include:

- Flat Networks of Teams: Breaking down silos and creating pools of analysts who can be assigned to priority projects based on business needs.

- Temporary Teams for Deep Insights: Adopting agile principles like sprints to address complex business problems and deliver actionable financial analyses.

- Integrated Technology Ecosystems: Leveraging automation, AI, and advanced data management practices to streamline operations and improve decision-making.

2. Harnessing the Power of Real-Time Data

Data has become the lifeblood of modern finance, and financial giants are investing heavily in real-time data capabilities. By 2025, organizations aim to:

- Establish Centralized Data Lakes: Unified repositories for key performance indicators (KPIs) and financial metrics.

- Enable Real-Time Dashboards: Providing instant insights into financial performance and enabling detailed drill-down analysis.

- Reduce Manual Efforts: Minimize time spent on data collection and manipulation, allowing teams to focus on strategic tasks. For instance, a global consumer goods manufacturer recently reduced FP&A tasks by 65% through such initiatives.

3. Embedding Digital Skills Across the Organization

Digital transformation is no longer optional; it’s a necessity. By 2025, finance teams will:

- Program Automation Bots: Use RPA (robotic process automation) to handle routine tasks.

- Leverage Advanced Analytics Tools: Drive insights from big data to inform decision-making.

- Translate Data into Business Strategies: Equip professionals to turn numbers into actionable insights that drive value.

4. Redefining Performance Management

Financial giants are shifting from traditional performance evaluation methods to systems that are more aligned with strategic goals. This involves:

- Standardized KPIs: Harmonizing metrics across business units to align with overall value-creation roadmaps.

- Real-Time Performance Tracking: Using advanced tools to measure and visualize financial data instantly.

- Linking Performance to Strategy: Ensuring that every KPI contributes directly to organizational objectives.

Simplifying Transactions with Embedded Finance

Embedded finance is reshaping how we interact with financial services by seamlessly integrating banking products into everyday non-financial platforms. Imagine applying for a loan while shopping online or managing payments through a delivery app – without ever stepping into a bank. This shift will only accelerate in 2025, making financial processes almost invisible.

The aim is to eliminate the friction of traditional banking, offering effortless, on-the-go experiences that fit naturally into your digital lifestyle. As these services blend into the background, they’re revolutionizing the way we handle money, making financial tasks smoother, quicker, and more intuitive. Embedded finance is tearing down the walls between banking and daily digital interactions, giving users seamless access to the financial services they need right when they need them.

Personalization in Financial Services

Gone are the days of one-size-fits-all solutions. Today, customers expect financial services that understand and cater to their unique needs. They want experiences tailored just for them, whether it’s a customized investment portfolio or a loan package that suits their goals. Thanks to AI and advanced analytics, financial institutions can now offer these highly personalized services, making it easier to meet individual preferences and goals.

But personalization isn’t just about meeting expectations—it’s about building trust and loyalty. In an increasingly competitive market, customers gravitate toward businesses that truly understand them. Personalization is the key to building long-term relationships, ensuring customers feel valued and engaged every step of the way.

A Glimpse into the Future: Real-World Success Stories

Several organizations are already implementing aspects of this new operating model. A global consumer-goods manufacturer, for example, introduced a data lake to centralize metrics and deployed real-time dashboards to track financial performance. This initiative not only streamlined processes but also empowered the finance team to focus on delivering strategic insights.

Another example comes from the automotive industry, where companies are redefining leadership development. Senior finance executives are now required to gain experience in multiple divisions, countries, and even non-finance roles, ensuring a holistic understanding of the business.

As we approach 2025, financial giants are embracing a bold vision for the future. By integrating agile practices, leveraging real-time data, developing business-savvy leaders, and fostering a culture of continuous learning, they are positioning themselves to thrive in a dynamic and competitive environment. The finance organization of tomorrow will not just support the business but drive it forward, becoming a true strategic partner in achieving organizational success.