The 80-20 rule or the Pareto Principle states, “80% of your business comes from 20% of your customers.”.

Innovative sales & marketing professionals always understand the importance of “know your customer.” A process to verify and identify customers with a focus on customer retention, loyalty, and building lasting customer relationships.

Instead of analyzing the complete customer base as one whole, it would be pragmatic to segment them into homogeneous groups, understand various specific traits for each group, and engage them with relevant campaigns rather than segmenting on just cliché segments viz. age, income, or geography.

One of the most popular, easy-to-use, easy-to-implement, and effective segmentation methods is RFM analysis. Let’s take a closer look into the process, procedure, tools & techniques for this analysis.

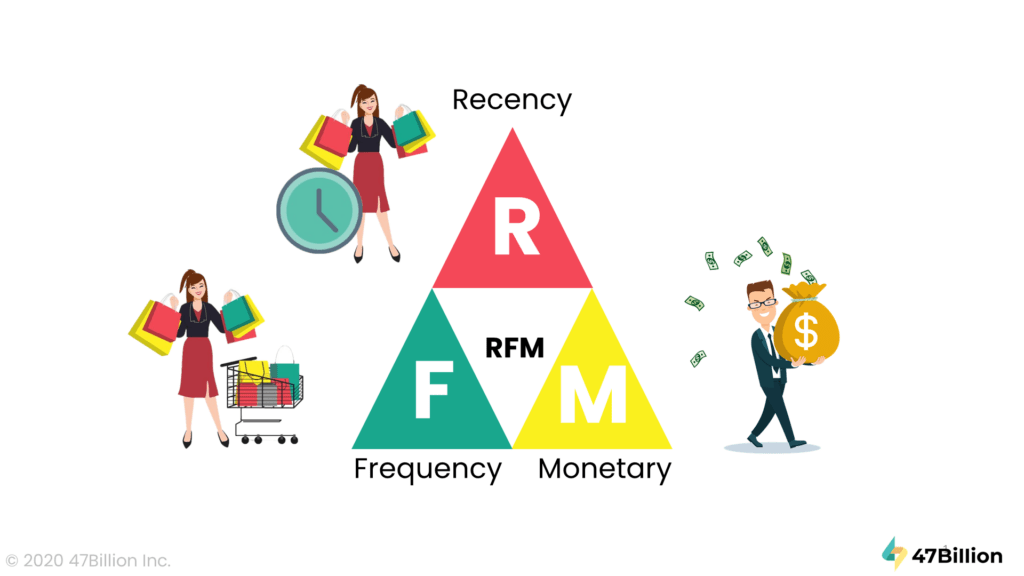

What is RFM (recency, frequency, monetary) analysis?

RFM analysis is a group segmentation technique used to categorize customers quantitatively based on their recent transactions’ recency, frequency, and monetary aspects. This is essential to identify the best customers and perform targeted marketing campaigns.

RFM analysis provides ratings for each customer on the following factors:

- Recency – Customers who recently purchased will still have the product on their minds and are more likely to buy or use the product again. So the critical question here is, “How recent was the customer’s last purchase?” (Normally measure of Recency is in terms of days. But, depending on the product/commodity type, any measure can be used years, weeks, days, or even hours.)

- Frequency – Customers purchasing once are often are more likely to buy again. The important question is, “how often did the customer purchase in a given period?” Another aspect of frequency is that first-time customers/users (FTU’s) are natural targets for follow-up advertising, Aiming to convert them into more frequent purchases.

- Monetary – Customers who make significant purchases are more likely to make investments in a similar range in the future; hence, such customers are always of high value to businesses. So the question is, “What amount of money did the customer spend in a given period?”

Once the segmentation is done, each customer is assigned numerical scores based on parameters to provide an objective analysis. Scoring is explained in detail in the next section.

How does RFM analysis work?

RFM analysis scores customers based on each of the RFM factors. A score range from 1 to 5 is most likely used, one being the lowest & 5 being the highest. However, depending on the type of product/commodity and its implementations, different teams may want to use different values or scales.

One method is where the analysts average these values together as an RFM value for each customer, then sort RFM Value from highest to lowest to find the most valuable customers. Another method advocates weighing the values of each factor (R, F, and M) individually. Each method has its pros & cons, so it’s up to the analysts which form is suitable according to the nature of the data.

Take, for example, a computers dealership that may find that an average customer is doubtful to buy several new Laptops in a few years. But a corporate customer or an institutional customer who buys several laptops or tablets multiple times is a high-frequency customer. Such high-value customers are most sought after by the sales team. Thus, the dealership may choose to weigh the value of the frequency score accordingly.

RFM analysis can also add value to organizations that do not sell products directly to customers. For example, non-profits organizations, trusts, and charity institutions can use RFM analysis to find the best donors; criteria can be those who have donated considerable times in the past are more likely to contribute again in the future.

Another exciting category of businesses is the ones that do not rely on direct payments from customers. These organizations may use different parameters for their analysis. These may consider the engagement value at the place of monetary value to perform RFE (recency, frequency, engagement) analysis rather than standard RFM analysis, basically the same technique as the latter.

For example, websites and apps that value readership, number of views, or interaction may use an engagement value instead of monetary value to perform an RFE (recency, frequency, engagement) analysis instead of a standard RFM analysis, basically the same technique as the latter.

For example, websites and apps value readership, number of views, or interaction may use an engagement value.

RFM analysis helps marketing team find answers to the following questions:

- Who are your best customers?

- Which of your customers could contribute to your churn rate?

- Who has the potential to become valuable customers?

- Which of your customers can be retained?

- Which of your customers are most likely to respond to engagement campaigns?

1 The churn rate, also known as the rate of attrition or customer churn, is the rate at which customers stop doing business with an entity.

Segmentation of customers in RFM analysis

RFM analysis is a highly powerful tool that helps professionals make the best of their advertisement budget.

RFM analysis is a highly innovative tool that helps marketing professionals to make the best of their advertisement budget. This is done by identifying and exploring the best set of customers out of the whole lot to invest in direct campaigns. This is also instrumental in increasing the quantum of sales and derive maximum conversions.

Businesses use findings from such analysis to identify clusters or groups of customers with similar range values instead of concentrating on the overall RFM average to identify their best customers; this process is called customer segmentation.

This process is used to produce S.M.A.R.T2 direct marketing campaigns tailored to specific customer types or groups already identified as a part of customer segmentation. Businesses can use email or direct marketing campaigns to target customers with Offers.

2 Specific, Measurable, Achievable, Relevant, Time-bound

Analyzing RFM Segmentation

- (5, 5, 5) Champions or Whales are the type of best customers, ones who bought most recently, most often, and significant invoice values. These customers are required to be rewarded. They are most likely to adopt newly launched products, which may help considerably promote the brand.

- (5, X, 5) Potential Loyalists are the recent customers with average frequency and considerable invoice values. These types of customers can be offered membership or loyalty programs. They may be also be recommended for related products or cross-selling their new products. They have the potential to become whales /champions.

- (5, 1, X) New Customers are customers who have a high overall RFM score but are not frequent buyers. Building relationships with these customers is highly recommended by providing them with necessary support and special offers to encourage better spending.

- (X, 4, 5) At-Risk Customers are customers who used to purchase often and at that used to have high invoice values, but they haven’t purchased recently. These may be sent personalized reactivation campaigns requests to reconnect or offer renewals along with new products details to encourage more purchase.

- (1, X, X) Lapsed customers / Can’t Lose Them are the type of customers who used to visit and purchase quite often but haven’t been around recently. They may be brought back with relevant promotions. Product satisfaction surveys could be initiated to find out what went wrong & where otherwise there is a high risk of losing them to a competitor.

Businesses have various tools at their disposal to segment customers for RFM analysis at the same time there are numerous other kinds of BI analytics methods available some similar some more refined.

Depending on the need at hand various tools, techniques, or various combinations of both can be utilized for further analysis.

How to perform RFM analysis

Various CRM software may integrate RFM analysis as a part of report generation, and many add-on packages may exist that can take existing CRM data and automatically measure the RFM factors to provide graphical representations with suggestions.

Getting started with RFM analysis is actually quite simple, in fact as simple as using imported data in MS Excel or any other suitable spreadsheet application.

Organizations can export a customer’s purchase history from a CRM database or directly import purchase history into the spreadsheet as raw data from text or using a query, for instance, they can then sort by each of the RFM analysis defined parameters to assign a relative score for each value scaled appropriately as per the business type.

For example,

A departmental store may assign monetary scores as customers who spend $0-$99 as 1, $200-$600 as 3, and over $1000 as 5.

While,

An automobile dealership may assign monetary scores as customers who spend under $10,000 as 1, $10,000-$50,000 as 3, and over $100,000 as 5.

Businesses can then use these assigned scores to create overall customer averages and customer segmentation groupings. Organizations can also use PowerPivot3 to create interactive charts to aid in analysis.

3 Power Pivot is a feature of Microsoft Excel. Power Pivot is an Excel add-in you can use to perform powerful data analysis and create sophisticated data models. It is available as an add-in in Excel 2010, 2013 in separate downloads, and as an add-in included with the Excel 2016 program

Case study

How Banks can use RFM Analysis

A known bank has expanded its business in the past few years. The management decided to include a separate team of Data Scientists, who would utilize historic data to make some important data-driven decisions. All this was aimed at providing the best services to their customers. The data scientists use various advanced Data Analytics and Data Science techniques for extracting insights from the customer data collected through different sources within the bank.

They performed a Recency, Frequency, and Monetary, that is, RFM analysis on the debit card usage data of its customers initially. The idea behind this move was to provide a more personalized customer banking experience by providing attractive targeted offers. Based on the success rate this was extended to improve new onboarding of customers with cross-selling banking products and services.

The results of this analysis and subsequent offers were highly overwhelming. They found that after the offers were released, the average spending of an individual customer increased by 29%, while the spending of the targeted customers increased by 44%. This resulted in an overall 27% growth in the overall portfolio spend.

Limitations of RFM analysis

While using RFM modeling can provide valuable insights about customers and groups, it does not take into account many other factors about the customers like type of item purchased or customer campaign responses as factors, Customer demographics such as age, sex and ethnicity etc. Many of these are required for performing In-depth targeted marketing, as the marketing professionals may want to use as much detailed analysis as possible.

Another aspect is that RFM analysis only uses historical data about customers and hence may not predict future customer activity given its limitations. Predictive methods may be able to identify future customer behavior that RFM analysis cannot, hence advanced Data analytics methods need to be introduced as the next step.

It is highly recommended that organizations should have a maturity-based growth path for shifting to more detailed analytics gradually over a period of time.

Conclusion

RFM analysis is a data-driven customer segmentation technique that allows marketing professionals to take tactical decisions based on severe data refining iterations. It empowers them to quickly identify and segment users into homogeneous groups and target them with personalized marketing strategies for specific purposes, thereby improving user engagement and retention. Understandably, RFM analysis is still a very primitive data analytics solution /method. Highly effective but still a stepping stone in the long line of analytics that can be performed on the organizational data

The scope is endless in data analytics; advanced techniques are being derived with a wide range of applications daily. Organizations should opt to follow a growth plan to attain maturity in terms of data analytics. The process has to be gradual but is much needed in the longer run.

Since RFM Analysis is a fundamental analytics model, the organization could initiate it as a data analytics initiative. Advantages include zero extra investment, can be executed with the help of home-grown analysts, simple yet effective tool for teams to get acquainted with analytics, and teams can play with results to derive valuable insights.

We’ll look at some advanced data analytics methods, solutions, types, tools, and techniques in future blog posts.