According to Precedence research, the global Generative AI in banking and finance market size is estimated at $712.4 million in 2022 and expected to reach around $12,337.87 million by2032, poised to grow at a CAGR of 33% during the forecast period by 2023-2032.

For over a decade, AI has propelled the financial services industry forward, enabling notable advancements such as better underwriting and improved foundational fraud scores.

While AI has proven beneficial to finance businesses in diverse ways, the financial services industry has embraced generative AI. It is extensively harnessing its power as an invaluable tool for its operations. While traditional AI/ML is focused on making predictions or classifications based on existing data, generative AI creates novel content by analyzing patterns in existing data. This versatile technology can generate content in a wide range of modalities, including text, images, code, and music, making it ideal for various use cases. Its potential to enhance accuracy and efficiency has made it increasingly popular in the finance and banking industries.

Accelerated adoption in Financial Services –

The increased competition has fuelled the rapid adoption of AI/ML in the financial sector in recent years by facilitating gains in efficiency and cost savings, reshaping client interfaces, enhancing forecasting accuracy, and improving risk management and compliance. GenAI could deliver cybersecurity benefits ranging from implementing predictive models for faster threat detection to improved incident response. Despite this rise in the adoption of Generative AI, there are associated risks that need to be fully understood and mitigated by the industry and prudential oversight authorities.

Applications of GenAI

GenAI has three major applications in the financial services industry –

- Making online interactions conversational (e.g., conversational journeys, customer service automation, knowledge access, and others)

- Making complex data intuitively accessible (Such as enterprise search, product discovery and recommendation, business process automation, and others)

- Generating content with a single click (e.g., creatives, document generation, developer efficiency, and others)

Exploring use cases in the complete Financial Services Industry Ecosystem–

Financial Document search and synthesis –

Financial organizations spend a significant amount of time summarizing information and documents internally. GenAI can help them effectively find and understand the information in contracts such as policies, credit memos, underwriting, trading, lending, claims, and regulatory, as well as unstructured PDF documents.

For example, GenAI can help analysts accelerate report generation and research and summarize thousands of economic data or statistics from around the globe.

Financial Modelling – Business owners spend hours developing financial models and segregating all the individual components of the model. A generative AI-based solution can help in developing an overall financial model for any organization based on a question/problem the user asks through prompt mentioning terms relevant to the business.

The solution can segregate the model into individual components and define the specificity of the model.

Specialized Chatbots –

Several customers need help finding answers to a specific problem that is personalized, not pre-programmed. For example, they assist in resolving fraudulent transactions. That kind of information won’t be readily available in the usual AI chatbots or knowledge libraries. That’s where GenAI comes into play. It helps customers get the answers they need. It excels in finding answers in large datasets, summarizing them, assisting customers, and supporting existing AI chatbots. GenAI-based chatbots are conversational and more personalized. These capabilities help provide improved customer service experiences.

Market Research –

Investment firms analyze diverse company filings, transcripts, reports, and complex data in multiple formats to understand global markets and risks. In capital markets, gen AI tools can serve as research assistants for investment analysts. Such assistants can help sift through millions of event transcripts, company filings, consensus estimates, macroeconomic reports, regulatory filings, and other sources and help identify and summarize key information.

Personal Consultant for developers –

In the financial services industry, new regulations emerge every year globally. At the same time, existing rules change frequently, thus requiring a vast amount of manual or repetitive work to interpret new requirements and ensure compliance.

In this scenario, developers need to understand the underlying regulatory changes to update the code quickly. Here’s where generative AI comes into play. It helps developers with context about the regulatory or business changes. It assists in automating coding changes, along with helping in cross-checking or verifying the code against the code repository and providing documentation.

Take the example of III International banking regulation requirements that include a large number of pages of documents. GenAI can help in summarizing a relevant area of Basel III to help developers understand the context, identify the parts of the framework that require changes in code, and cross-check the code with the Basel III coding repository.

Personalized Financial Recommendations –

While existing machine learning tools are well suited to predict marketing and sales tactics for particular customer segments based on customer behavioral patterns, it is not easy to operationalize those insights. For example, curating marketing emails or in-app messages with specific financial recommendations can be time-consuming. Gen AI can help in creative processes of one-to-one personalized messaging at scale using conversational language. It can help improve customer experience, retention, and cross-sales.

Generative AI is not merely a technological evolution but a revolutionary force reshaping the financial landscape. Its transformative impact is undeniable. The synergy of advanced machine learning algorithms, a surging volume of financial data, and the cost-efficiency imperative propel its integration across various sectors. From personalized customer experiences to enhanced risk management and compliance, generative AI is not just a tool; it’s a catalyst propelling the financial industry into a future defined by innovation, efficiency, and unprecedented strategic advantage. Generative AI is revolutionizing the way we live, work, bank, and invest. Generative AI represents a massive productivity and operational efficiency boost where every service or product starts with a contract, terms of service, or other agreement. It mainly helps in discovering and summarizing complex information such as mortgage-backed securities contracts or customer holdings across various classes.

The foundational models, such as LLMs, are trained on text or language and have a contextual understanding of human language and conversations. These capabilities are particularly helpful in speeding up, automating, scaling, and improving the customer service, marketing, sales, and compliance domains.

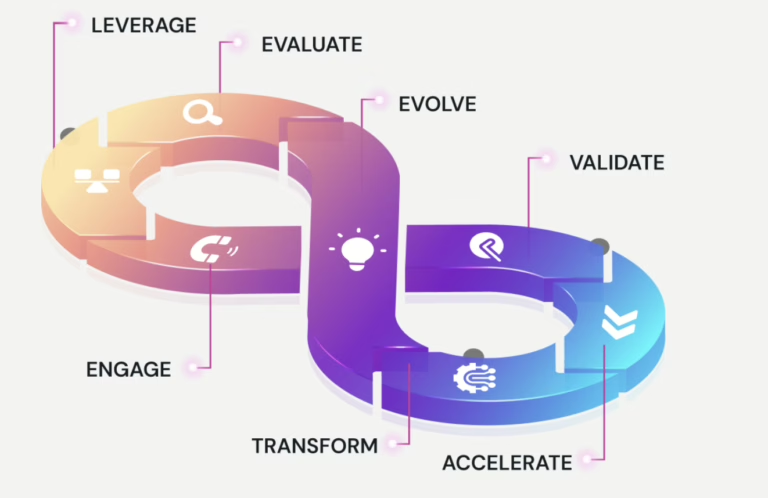

From Vision to Implementation

This a call for all financial services leaders; you are no longer required to experiment. You already have a way to build and roll out your most innovative ideas.

Get started

Gen AI is not just a new buzzword. It has become a new way for businesses to create value. For more details on jumpstarting your journey, let’s connect at hello@47billion.com