The demand and value for fast and high-quality financial engineering, financial analysis, and forecasting have increased over the past years as we have entered the age of customer-centric services.

Big Data has grown beyond the realm of technology. It has become a business imperative. Data analytics is taking over the finance industry by bringing solutions to several business challenges for banking and financial markets and companies worldwide.

The finance industry is leveraging data analytics to transform its processes. The Banking and Finance industry sees millions of daily transactions. Each adds another row to the industry’s immense and growing ocean of data.

How do these firms use this information to gain a competitive advantage?

As per IBM’s research, 71 percent of these banking and financial markets firms report that using information (including big data) and analytics creates a competitive advantage for their organizations, compared with 63 percent of cross-industry respondents.

Also, these firms deal with a very diverse and demanding customer base that insists on communicating and transacting business in new ways. While the banking industry’s customer data is growing in size and scope, unstructured data is growing as an even more prominent and essential source of customer insight.

All the front-line employees, such as investment bankers, financial advisors, relationship managers, and loan officers, are ready to access detailed customer information to make better decisions and support regulatory and compliance reporting requirements. Today financial services organizations are taking a business-driven approach to big data. The most compelling data strategies involve identifying business requirements and leveraging existing resources, data sources, and analytics processes to support the business opportunity.

Why has Data Analytics become vital for Finance Industry?

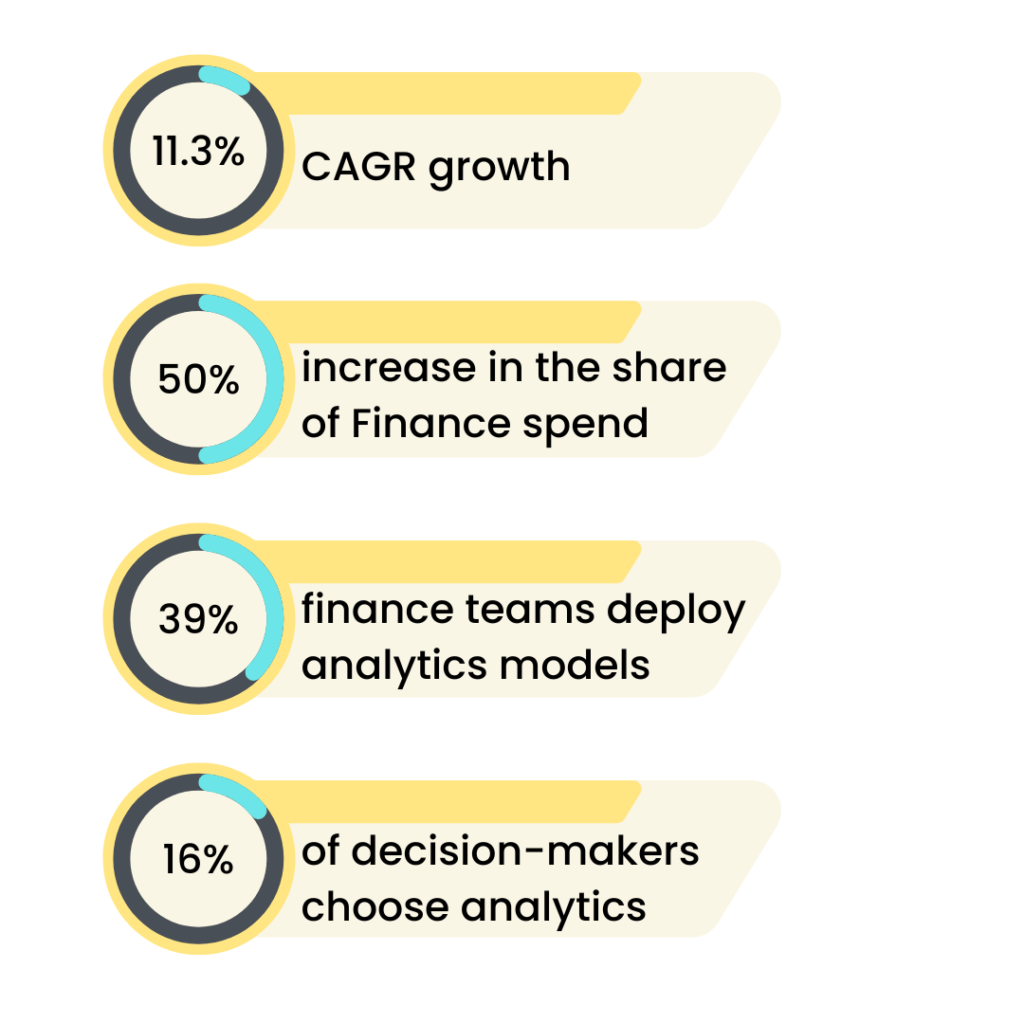

- The Global Financial Analytics Market will reach $17.1 billion by 2028, an 11.3% CAGR growth.

- 16% of decision-makers feel financial data is easy to use for decision making

- Progressive finance leaders are using data analytics to provide executives with refined information.

- Only 39% of finance teams deploy technologies that can predict future events.

- There has been a 50% increase in the share of Finance spent on analytics in past years.

How is Analytics revolutionizing the finance industry?

Customer data is changing rapidly, and so are the KPIs. The existing business model should factor in the data coming in from disparate sources. Data analysis can lead to actionable insights.

Let us talk about some advanced analytics use cases with evolving customer ecosystem –

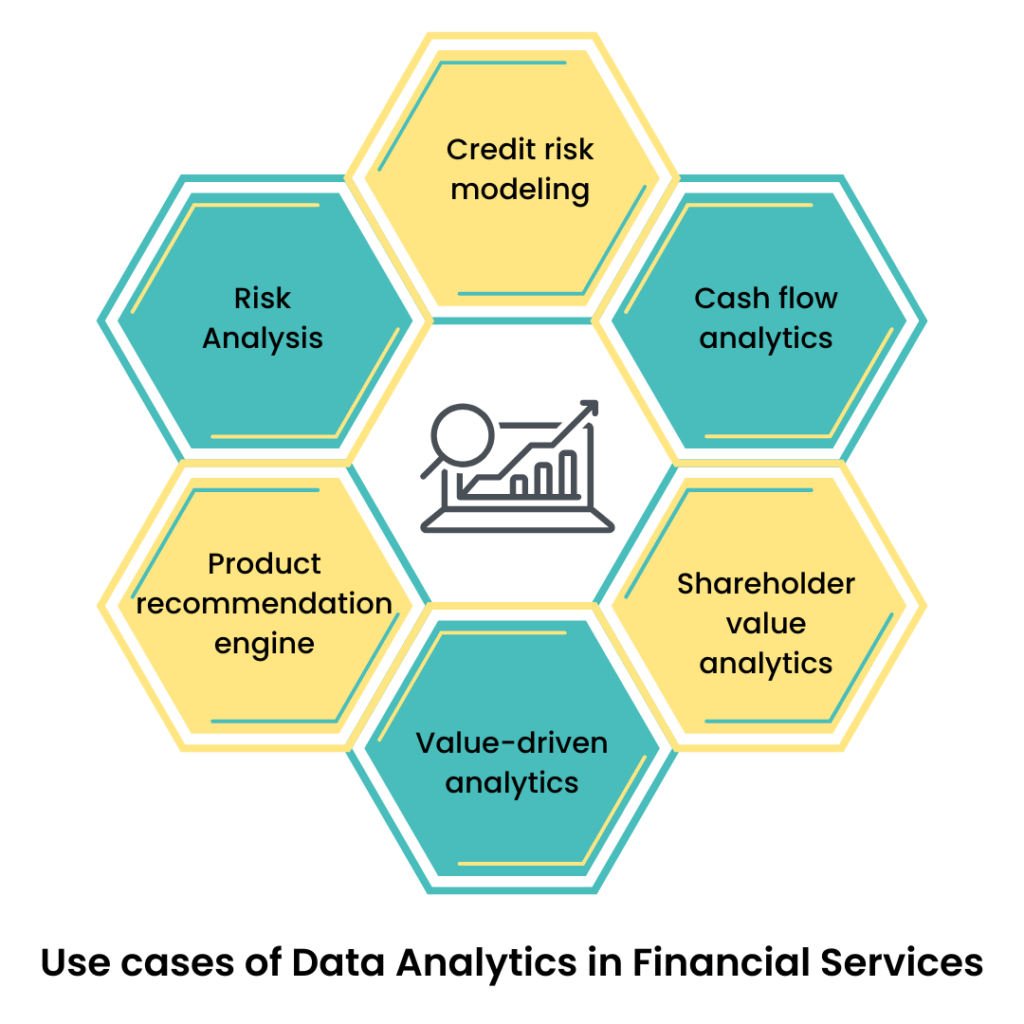

Credit Risk Modeling– Traditional risk analytics models provide insights based on income sources, loan history, default rates, credit rating, demographics, etc. Numerous other touchpoints are needed to be analyzed along with standard data. For example, consumer loan dynamics like social media profiles, utility bills, monthly spending, and savings provide more accurate insights. Unstructured data plays a vital role in credit risk modeling today. Also, AI-based text analysis and consumer personas offer profound insights into customers’ financial status.

Risk Analysis– Financial organizations implement dynamic risk models based on advanced analytics that are more resilient to significant external variations. Advanced analytics models now enable organizations to analyze many transactions based on historical data and social media profiles. These behavioral analytics, and predictive analytics help in rendering frauds occurring online.

Product Recommendation Engine– Recommendation engines have moved beyond eCommerce and entertainment. They have got their market in financial services as well. Multiple comparison sites are available for each financial product, whether loan, insurance, mutual funds, credit cards, etc. Consumers can make informed choices. Machine learning models process the data in real-time from various content feeds to provide personalized products and services.

Personalized Marketing and Customer Segmentation- Understanding customer behavior is vital for personalization. The reports related to marketing efforts applied play a very crucial role. They help in building trust and getting a response to the marketing messages devised for selling products or services. Ultimately improves customer retention.

AI-powered Virtual Assistants- Customers today prefer efficient self-service options for processing their requests. AI-powered virtual assistants add value in answering all queries. Virtual assistants are automating insurance claim processing with human-like interfaces.

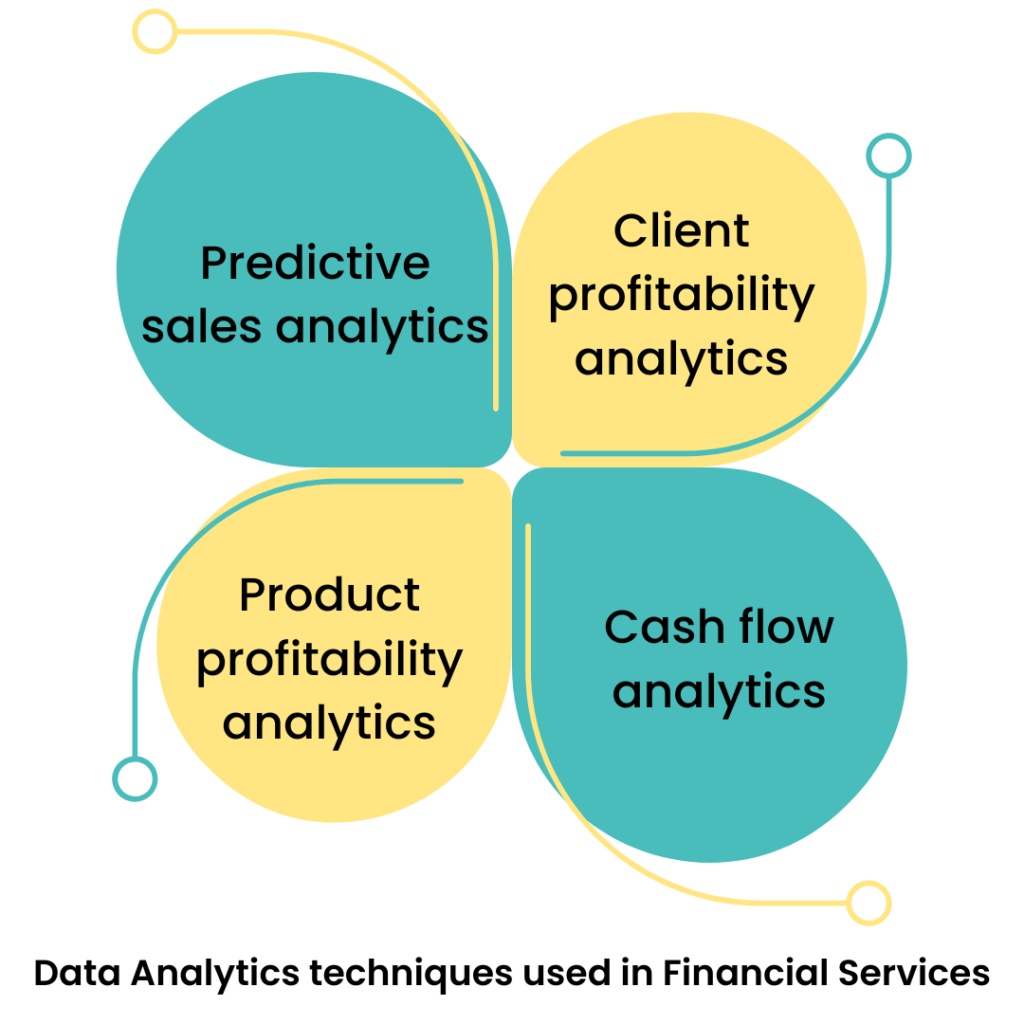

Analytics Techniques used in Financial Services

Predictive Sales Analytics

Correlation analysis and past trend analysis are the two primary methods to predict sales. It helps with planning and managing business peaks and throughs.

Client Profitability Analytics

Businesses require segregation between clients who make money and clients who provide it. Customer profitability helps analyze every client group and customer contribution to gain valuable insights.

Product Profitability Analytics

In the competitive landscape, organizations need to know about their profits. Product profitability helps establish the profit gained from every product rather than analyzing the business. For this, assessing every product is essential. Also, this technique helps establish insights across the product range for better decision-making.

Cash Flow Analytics

Cash flow is the lifeblood of your organization. Understanding cash flow is crucial for understanding the health of the business. It involves real-time indicators such as the working capital ratio and cash conversion cycle. You can also predict cash flow using regression analysis.

Want to know more about data analytics applications and techniques in financial services? Get in touch with our experts.

47Billion offers you a team of experienced Big Data professionals. Our offerings involve transforming various aspects of financial services with a 360° approach, accommodating our customers’ requirements.

Our personalized approach delivers efficient and sustainable solutions with contextualized domain knowledge wired into technology solutions.